What Is A Yield Curve?

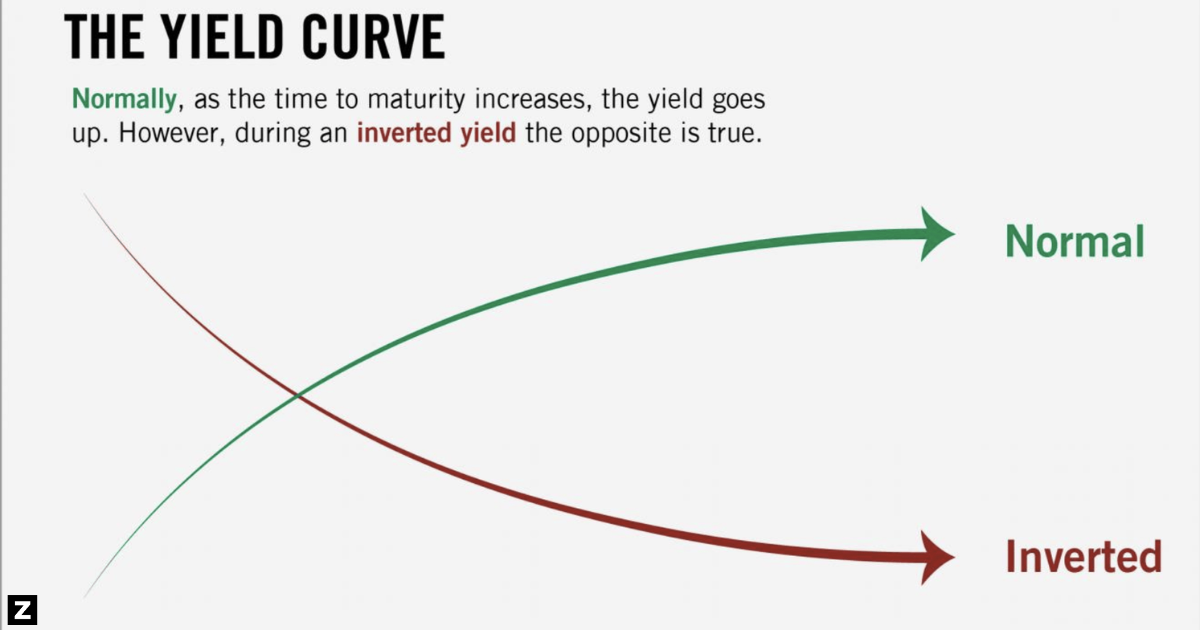

The Treasury yield curve is a graph that charts the interest rate on Treasury bonds, notes, and bills versus their maturity (time until they pay back principal).

Normally it slopes upward, from left to right. When you think about it, it makes sense. Bondholders demand a higher rate of interest to lend money (i.e., hold bonds) for a longer period of time. What Is An Inverted Yield Curve?

What Is An Inverted Yield Curve?

When the curve is “inverted,” it is downward sloping from left to right, which means you will be paid less to hold bonds for a longer time. This scenario makes no sense for the individual investor. Why would you invest to earn less interest on a 30-year bond than on a 2-year bond? In most cases, you wouldn’t.

Why Does An Inversion Matter?

An inverted, 3month to 10 year USTreasury yield curve has had strong predictive power that a recession is coming. Typically, the recession is roughly 2 years out.

A normal, upward-sloping curve suggests that the economic outlook is positive. Better times are anticipated, and as one would expect, it costs more to borrow money for the long term, and one receives a higher rate of interest to invest long term.

An inverted, downward-sloping curve suggests that the outlook is negative or the economy is slowing.

Is This Time Different?

In September of 2018, I wrote a post entitled “Is This Time Different?” which asked, “Does A Flattening Yield Curve Predict A Recession?”

Rick Santelli of CNBC interviewed Arturo Estrella of the Federal Reserve Bank of New York. Estrella stated that an inverted yield curve between 3 month Treasury Bills and 10 Year Treasury Bonds had predicted all 7 U.S. recessions that have occurred since 1968.

Currently, the 3mos/10yr remains positively sloped; the 2yr/10yr and 5yr/10yr are negatively sloped or inverted and the curve all the way from 10 years to 30 years is almost flat.

The 2yr/10yr inversion has been less accurate at predicting a recession than the 3mos/10yr spread.

What Are The Bond Gurus Saying?

Mohamed El-Erian – Allianz

Stagflation is the baseline.

This is the time to take some chips off the table.

Jeff Gundlach – DoubleLine – “The New Bond King”

Right on cue, the “It Doesn’t Matter This Time” white papers are coming out, the DoubleLine Capital CEO tweeted. “Don’t believe them.”

Bill Gross – PIMCO retired – “The Bond King”

Bonds are definitely something to avoid.

They (the Fed) are way behind the curve.

If the ten year goes to 3, 3 1/2, or 4%, it will break the economy.

50-100bps more from the Fed and we will see a recession.

Inflation will be 4-5%.

Bill Gross referring to Jeff Gudlach:

To be a bond king, you have to have a kingdom. PIMCO was $1-2 trillion, Gundlach has $134 billion and is not growing.

Central banks and governments are the new bond kings and queens. The term is somewhat passe.

Bill Gross referring to Cathy Wood

She doesn’t have an excellent sense of value and when to buy and what to pay. She seems to think that down the road her theory will be validated.

For a more technical discussion of the yield curve inversion please watch the following video:

About The Author And Podcast Host

Tom Levine, leveraging a 25-year tenure in capital markets, leads Zero Hour Group and Native Angelino Real Estate, offering a suite of consulting, strategic analysis, and real estate services.

An alumnus of USC Marshall School of Business and the Claremont Colleges – Pitzer College campus with a term at the London School of Economics. Additionally, he holds a CADRE broker’s license (#02052698) and the designation certified Short Sale Specialist under the National Association of Realtors.

Have a challenging transaction? Let’s discuss.

I consult on a range of transaction types and deal structures.